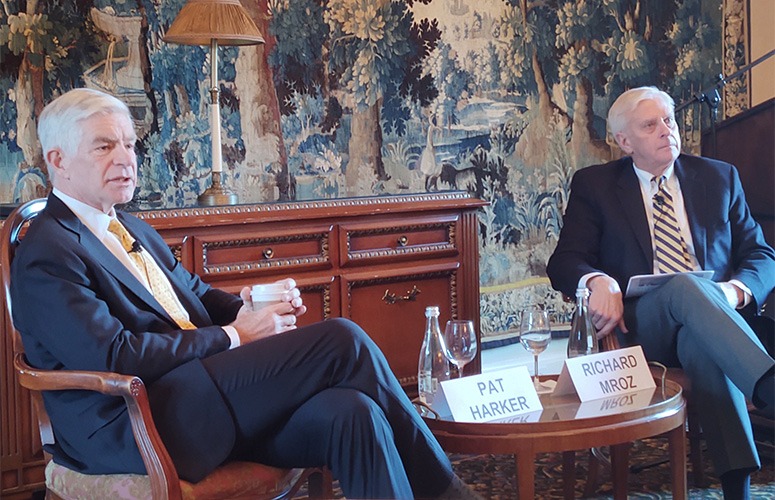

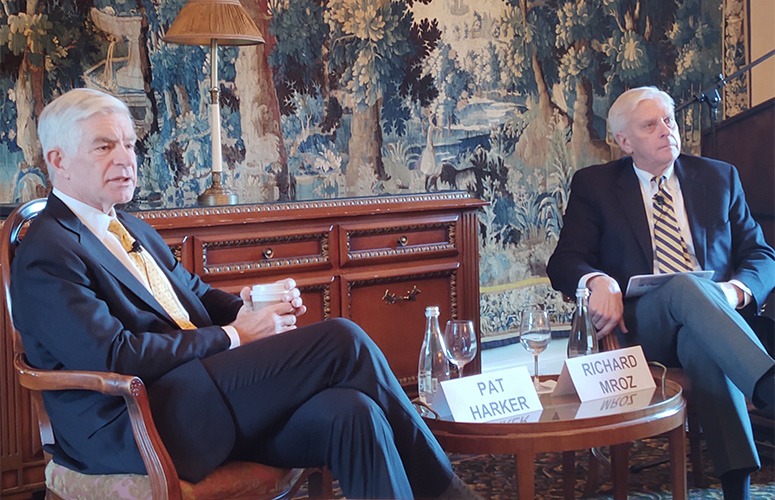

Patrick T. Harker (left), president and CEO of the Federal Reserve Bank of Philadelphia, with NACD-NJ Director Richard Mroz who served as moderator at last week’s economic forecast event.

Economy

By Anthony Birritteri, Editor-in-Chief On Jan 13, 2025

Heading into 2025, the US economy remains among the strongest and most stable in the world. According to Patrick T. Harker, president and CEO of the Federal Reserve Bank of Philadelphia, this has held true despite the aftershocks of the pandemic, high inflation, high interested rates as the Federal Open Market Committee (FOMC) responds to inflation, and various geopolitical issues.

Speaking at the National Association of Corporate Directors – New Jersey Chapter’s annual economic forecast last week at Jasna Polana County Club in Princeton, Harker, who expressed his own economic views and not those of the Fed, reported that while job growth pales in comparison to the monthly increases seen in the immediate post-pandemic years, today’s “weaker pace of job creation” is a deceleration back to what was trending before the pandemic.

“Over the past year, the average number of jobs created per month was lower than in the past couple of years. However, it remains consistent with monthly averages seen in the years leading up to the pandemic. We’re essentially back to where we were in 2018 and 2019, and the economy in those years was strong,” he said, adding, “The country is still creating jobs, and while people may find they are spending “a little bit more time on the job market, they are securing positions.”

AI’s Impact

When asked what industry subsectors were experiencing greater unemployment, Harker said it was technology due to the advent of artificial intelligence (AI). However, he – along with other economists he heard speak at a recent conference – does not know what the further implications of AI will be on the overall job market. “Will AI augment people’s existing skill sets or will it replace people? … That will vary by industry,” he said.

One growth area – due to AI, cloud computing, climate change, the move toward decarbonization, electric vehicles, and aging infrastructure – is electric power.

“We are now recommissioning nuclear power plants (as seen with Pennsylvania’s Three Mile Island, which will reopen in 2028 to power Microsoft data centers). It wasn’t cool to be a power engineer decades ago, but power engineering is back, and we are going to have to invest significant resources in [power] infrastructure,” Harker said.

“So, while some jobs will be lost as new technologies are introduced, new employment opportunities will emerge. It is incumbent upon [all of us] to adapt to this change,” he said.

Higher Ed & Workforce Training

Harker is a strong advocate for higher education and workforce development. As a past president of the University of Delaware and dean of the Wharton School at the University of Pennsylvania, he said he has “committed his career to ensuring that his students were well-prepared to become the workers [that businesses] could then foster in order [for the former] to have successful careers.”

Today, he says the pipeline of students – from high school, to college, to the workforce – is narrowing as fewer students are going to college. Meanwhile, institutions are having financial problems because of the lack of enrollment. “There are many factors at play here,” Harker said. “One reason is the escalating cost of a college education. When paired with the ongoing student-debt crisis, it’s making many students and families wonder if the investment in higher education is going to pay off in the long run.

“The current uncertainty across this landscape is going to change the way workers are trained and found,” he said. “We are at an inflection point. … In this effort and others, the Philadelphia Fed will continue to bring research to the fore to help guide discussions and foster a thriving and inclusive workforce and economy.”

Inflation and Interest Rates

The Fed will continue its mission of reducing inflation back down to the 2% level, with Harker personally believing that the 2% rate will be achieved in 2026.

The rate of inflation has already dropped by nearly two-thirds from its post-pandemic high of 9.1% in mid-2022, with the Fed working on reducing the rate for almost three years. However, over the past several months, inflation has proven to be “a little bumpy,” according to Harker. “We knew the path would not be a straight, downhill slide, especially if we want to stick to or our goal of a soft landing,” he said.

Conclusion

Harker has a positive outlook for the economy based on real-time data the Fed receives and analyzes. However, upside risks are always present. “Globally, the war in Ukraine, the situation in the Middle East, and the seeming instability of some governments in Europe are adding more uncertainty into the overall mix,” he said. “Here at home, we await potential policy changes which may have an economic impact. And dare I mention the impact that, say, a bird flu outbreak, on top of everything else, could have on food prices?”

Harker will step down from his position as president and CEO of the Federal Reserve Bank of Philadelphia on June 30 this year, as Fed regulation requires, after serving in the post for 10 years. He is the 11th president of the Philadelphia Fed and was reappointed for his second five-year term in 2021.

To access more business news, visit NJB News Now.

Related Articles: